UNDERSTANDING HEALTHCARE COSTS AT NORTHWEST INTEGRATIVE

We want you to feel confident and informed about your healthcare costs. That’s why we’ve put together this page to hopefully answer some common questions and give you a simple guide to help estimate your expenses. Our goal is to make things as clear and straightforward as possible so you can focus on what matters most—your health.

Disclaimer: By using this page, you acknowledge that the information provided is intended to offer general guidance and best estimates regarding medical billing, insurance coverage, and costs at Northwest Integrative Medicine. We unfortunately can’t make any guarantees here about the exact final costs, insurance coverage, or billing outcomes for services rendered.

FAQs

What Exactly is Medical Billing?

Medical billing is the process of identifying and billing for the medical services and items you’ve received—such as healthcare services, tests, supplies, equipment, or procedures. Each service or item has a nationally standardized code—either a CPT code, an HCPCS code, or sometimes both. Generally, CPT codes are used for common services and procedures, while HCPCS codes are used for supplies, equipment, and specialty medical services. However, some insurers still require HCPCS codes for office visits, extended time, and other routine healthcare services. After your visit, everything is coded and bundled into a single bill, called a medical claim, which is then sent to insurance for processing.

What is a CPT Code?

CPT (Current Procedural Terminology) codes are standardized medical codes used by healthcare providers to bill for most medical services. These codes ensure providers are charging the same, or similar, amounts for the same services to patients and insurances. This way, whether you pay out of pocket or through insurance, the price per service stays the same.

What is a Medical Claim?

Once all your medical services are identified and listed as CPT codes, those codes are bundled into a medical claim (which is basically like an itemized bill of your medical services). If your medical claim is billed to insurance, they review it alongside your insurance plan’s details to determine how much they’ll cover and what you’ll owe. What you owe might include things like deductibles, copays, coinsurance, or more, depending on your plan.

What is an EOB?

An Explanation of Benefits (EOB) is a statement provided to you by your health insurance company. It details how your insurance benefits were applied to a medical claim. Which is another way of saying that an EOB is a summary of the medical claim your healthcare provider sent to your insurance company. It also details how much your insurance company paid on your behalf, and how much you may still owe.

How Do I Know What My Insurance Covers?

To get the most accurate estimate of your insurance benefits, it’s best to contact your insurance provider directly. They’re your best resource for understanding what to expect.

ESTIMATING COSTS USING CPT CODES

Understanding your costs can help you plan for your healthcare expenses. CPT codes can be a great tool for estimating what you might owe for a service, or trying to make sense of your medical bill. Here’s a breakdown of the CPT codes we use:

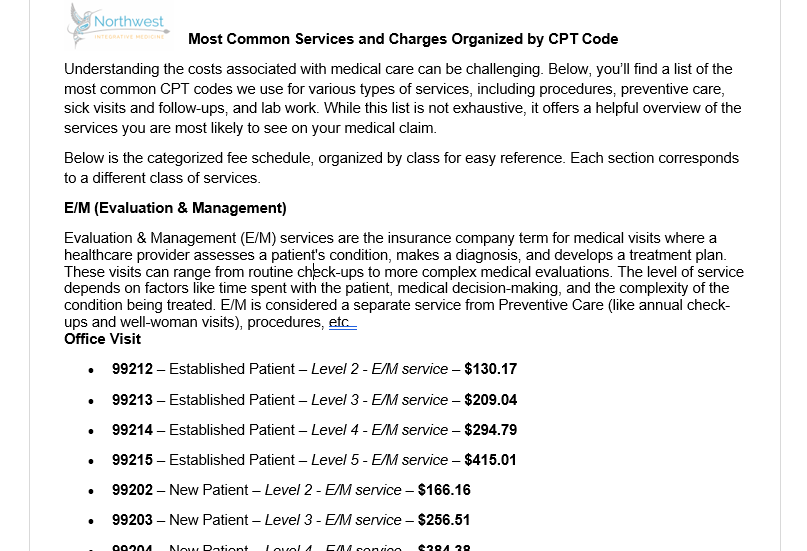

Most Common CPT Codes

Below, you’ll find a list of the most common CPT codes we use for various types of services, including procedures, preventive care, sick visits and follow-ups, and lab work. While this list is not exhaustive, it offers a helpful overview of the services you are most likely to see on your medical claim.

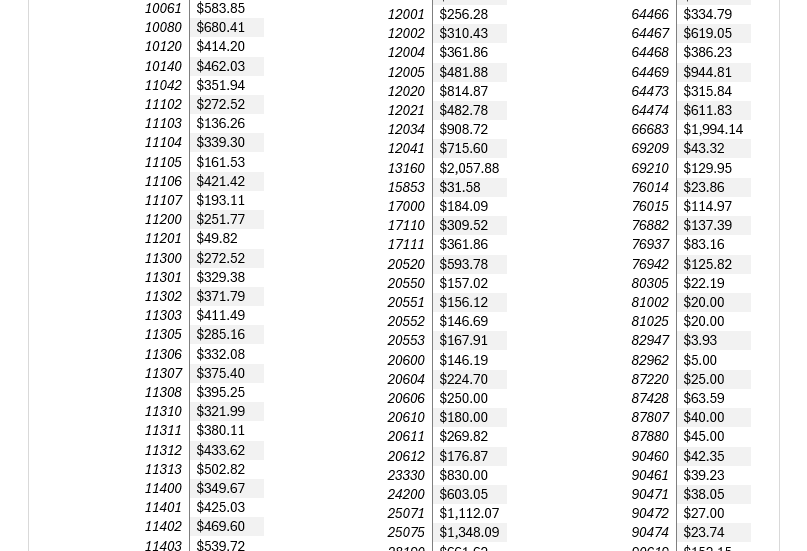

The Full Breakdown

For those who want a complete view of the services we offer, we’ve created a comprehensive list of all our CPT codes. This full list includes every service, procedure, and test provided at Northwest Integrative Medicine, along with their associated charges based on Oregon’s public medical fee schedule.

How Do I Use CPT Codes to Estimate My Costs?

This can be a little tricky if you’re looking for exact costs. There are a lot of CPT codes, and they can cover a wide array of services. There are unique codes for everything from your provider reviewing a health history form, to you having a twenty minute, in-person visit with your usual doctor that involved complex decision making. As a result, it’s not always possible to predict each CPT code beforehand (especially for complex or evolving medical needs). But, here are some steps you can take to get a clearer picture:

Review Our Common CPT Code List: It breaks down the most common CPT codes you are likely to see for a range of visit types. This can be a starting point for understanding typical costs. It can also arm you with some great tools for speaking with your insurance company. And, if you ever need help, please don’t hesitate to give us a call!

Check Your Insurance Coverage: Contact your insurance company to verify your coverage for our most common CPT codes . Many insurers have online tools or customer service lines to help you estimate your costs. See Health Plan Transparency Guidelines (CMS.gov).

Out-of-Pocket (OOP) Payments: If you choose to pay OOP, know that we use a minimal billing approach (explained below). Don’t forget to apply the 25% discount we offer patients who pay completely out of pocket to your estimate.

ONLINE COST ESTIMATOR TOOLS (COMMERCIAL INSURANCE)

Many insurance providers offer tools to help you estimate the cost of medical services before your visit. We’ve compiled a list of cost estimator tools provided by various insurance companies to help you better understand potential out-of-pocket expenses. These tools are designed to give you personalized estimates based on your insurance plan, network providers, and the services you may need.

- Aetna: Aetna Cost Estimator Tool

Log into your Aetna Membership account to get estimates with their cost-estimator tool. - Regence Blue Cross Blue Shield: Regence Treatment Cost Estimator

Log into your Regence Members account to get estimates with their cost-estimator tool. - Care Oregon: Care Oregon Resources

While Care Oregon doesn’t offer a specific estimator tool, members can access helpful resources for managing healthcare expenses. - First Choice Health: First Choice Price Transparency Tool

- Moda Health: Moda Healthcare Cost Estimator

Log into your Moda account to get estimates with their cost-estimator tool. - HMA (Healthcare Management Administrators): 1-800-869-7093 (Mon-Fri 5:00 am – 6:00 pm)

While HMA does not provide an online cost estimator, members can contact HMA directly for assistance with cost inquiries. - Pacific Source Health Plans: Pacific Source Treatment Cost Navigator

Log into your InTouch account to get estimates for healthcare costs. - Providence Health Plan: Providence Treatment Cost Estimator

Log into your MyProvidence account to get estimates for healthcare costs.

OUT-OF-POCKET COSTS

To make healthcare costs as transparent and manageable as possible, we provide access to a full list of CPT codes on this page, which detail the services we offer and their associated costs. Additionally, we’ve adopted a “minimal billing” approach for patients who choose to pay out of pocket (OOP), ensuring you only pay for the most essential services rendered during your visit.

What is Minimal Billing?

Our minimal billing approach means that when you pay OOP, we only bill for the primary services provided—typically just the Evaluation and Management (E/M) code associated with your visit. This simplifies your costs and keeps your expenses as low as possible.

Example: Minimal Billing for a New Patient Appointment

Here’s an example of what minimal billing might look like for a new patient visit:

Example Services Provided by CPT Code

99203: Level 3 – New Patient Office Visit (30-44 minutes, limited MDM, low complexity).

$256.51

96127: Emotional/Behavioral Assessment (e.g., depression inventory), 2 assessments.

$40.00

96160: Health Risk Assessment, 2 assessments.

$32.00

G2211: Add-on for E/M services:

$48.00

Insurance Billing

If billing insurance, all services listed in this example would typically be submitted, resulting in a total charge of $340.51. Depending on your insurance, you may be responsible for a portion of these charges (copays, coinsurance, or deductibles).

Minimal Billing

Under minimal billing for OOP patients, you would only be charged for the 99203 E/M code ($256.51). Additionally, OOP patients receive a 25% discount, reducing the final cost to $192.38.

Estimated Cost for Out-Of-Pocket (OOP) Visits

While every visit is billed based on the individual care provided, the following estimates can help you plan. Please confirm these estimates before scheduling, as they may vary based on recent updates or additional services like labs or assessments.

New Patient Appointments (Establishing Care)

- Standard Costs: $170 – $510

- With 25% Discount: $125 – $380

Established Patient Appointments (Follow-Ups)

- Standard Costs: $130 – $415

- With 25% Discount: $98 – $312

Wellness Visits (Preventive Visits like Well-Child & Annuals)

- Wellness Visits: $250 – $340

- With 25% Discount: $188 – $254

These estimates are approximations and may not account for all factors influencing final costs.

If you have questions about our minimal billing approach, CPT codes, or what to expect during your visit, feel free to reach out to us at (503) 855-4341. We’re here to help!

BEFORE YOUR APPOINTMENT

It’s essential to confirm your insurance coverage directly with your insurance company. This ensures that there are limited surprises when it comes to billing and payment for your visit. Here’s what to do:

1. Contact your insurance company: Give them a call to confirm that you can be seen at our clinic and that the services we provide are covered under your plan.

2. Specify the provider you’ll be seeing: When you speak with your insurance representative, make sure to mention both the provider you’ll be seeing at our clinic and their supervising provider (Dr Maeghan Cook). You may also want to provide them with the National Provider Identifier (NPI) of both your provider and their supervisor (Dr Maeghan Cook). The NPI is a unique identifier assigned to healthcare providers, and it helps the insurance company accurately verify coverage.

- Meaghan Cook, ND | NPI: 156-889-9508

- Colleen Amann-Shah, ND | NPI: 154-8527-724

- Jennifer Samson, ND | NPI: 163-973-3801

- Mary Fu, ND | NPI: 1487129524

3. Confirm coverage: Ask your insurance company whether your chosen provider and/or their supervisor (Dr Maeghan Cook) are covered under your plan. This will help you understand any potential out-of-pocket expenses you may incur.

By taking these steps, you’ll ensure a smoother experience during your visit to our clinic, and you’ll have peace of mind knowing that your insurance coverage is confirmed in advance.

If you have any questions or need assistance with this process, consider downloading our Insurance Verification Worksheet. And please don’t hesitate to reach out to our clinic staff! We’re here to help you every step of the way: (503) 855-4341.